Two of Oracle’s favorite contracts, the Unlimited License Agreement (ULA), and the Universal Cloud Credit (UCC) contracts, offer deep insights into how Oracle uses contracts, policies, technology, and high-pressure sales tactics to significantly raise your costs over time.

Clients ask for independent view on Oracle costs

Because Oracle focuses on the ULA and UCC customers, it is critical that you understand how Oracle uses these agreements to raise your costs over time. The ULA and UCC can be very good short term agreements, but staying in them over time will quickly double and triple your annual Oracle costs. We encourage everyone working with Oracle to conduct a thorough long-term financial model that takes into account how these agreements can trap you.

As we produce financial models for our clients, we are constantly highlighting the long-term ULA/UCC cost increases Oracle wants to force on you. A close look at these contracts shows both Oracle ULA and UCC contract have almost exactly the same financial impact on your bottom line. They are literally the same thing when you look at them through a cost lens.

Examining the similarities between ULA and UCC

An Oracle ULA and UCC contract are both limited in duration.

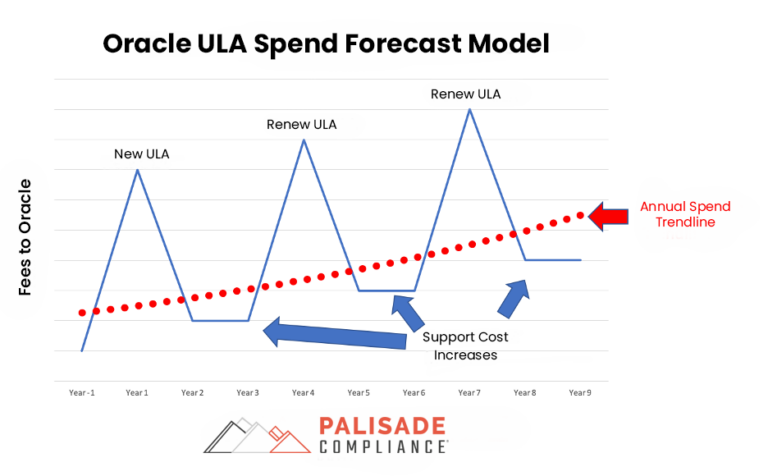

For the purposes of this article, let’s say we have a 4-year ULA and a 4-year UCC. Oracle likes it when you renew your ULA every four years. In fact, they want you to renew that ULA so much, they have inserted their aggressive and sales-focused LMS audit team into every ULA agreement. Below you can view the cost impact on a client who signs a ULA and then renews it a couple of times.

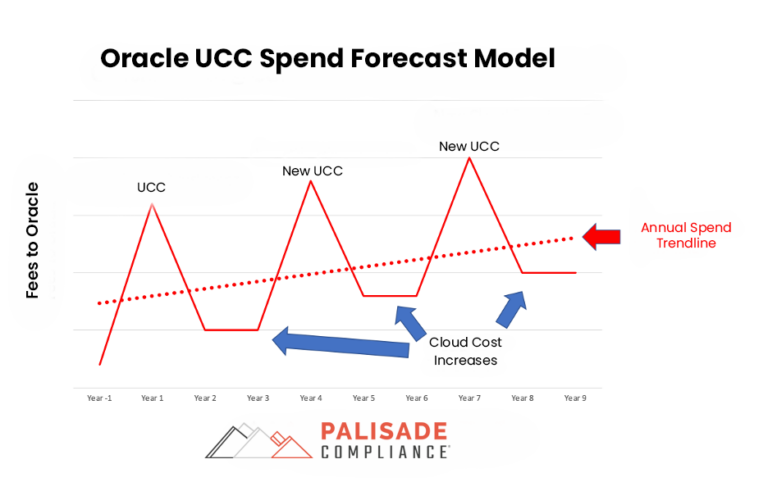

Now let’s do the same modeling, but this time for Oracle’s UCC. Like the Oracle ULA, the Oracle UCC also has a long track record. We know that Oracle’s record with clients is 100% clear … charge them more money every year whether or not those clients use more Oracle or get more value from Oracle. In fact, Oracle will charge more money even when clients get less value from Oracle! (think technical support).

Using that as our benchmark, we’ve created many financial models for clients. Below you can see an example of what Oracle wants to do with the UCC contracts, i.e. sign up a customer and have them renew (the same parameters we used for the ULA model above).

Two things jump out when looking at this chart. Firstly, your Oracle costs go up and not down. (Remember this when your Oracle rep tells you that your costs will go down with Oracle cloud.) Secondly, the ULA chart and the UCC chart are almost identical! Take a look side by side. It’s almost as if Oracle planned this intentionally.

Financial model similarities not accidental

Oracle doesn’t invite me into their planning and strategy sessions any more. (I wonder why?) However, I do know that Oracle plans out everything, and these financials are not accidentally identical. I am positive they are intentionally the same.

Oracle, like other technology vendors, wants the largest possible slice of your IT budget.

Oracle knows they can’t get it all at once, so what Oracle does it take over your budget in chunks. They have been extremely successful in setting up a business model where they lock you in technically and contractually, and then tighten the screws every few years to force you into another larger purchase.

With both the Oracle ULA and UCC, you are forced into an action every few years. Certify your ULA or move off Oracle Cloud. This event gives Oracle leverage to extract more revenue from you. This is especially true of the UCC contract and is why Oracle is pushing subscriptions over perpetual license. It’s much easier to certify out of a ULA than it is to move off of Oracle cloud.

How to avoid the cost increases

If you enter a ULA or UCC without a plan, you are going to get steamrolled by the Oracle cost-increase train. Only with proper planning and execution can you get the most from these agreements and keep your costs down. Yes, it is possible to spend less with Oracle. Just remember that Oracle will never ever help you do that. No one at Oracle makes more money if they help you spend less with Oracle. Negotiating proper terms and conditions, managing your deployments properly, and always having an Oracle exist strategy are key. If you can get to the end of your ULA or UCC and you can tell Oracle “How about I don’t renew, and how about I give you nothing”, then you will see the cost of a renewal go down, and your terms will be much more negotiable.

Palisade Compliance is in the business of helping our clients tell Oracle “how about we give you nothing”. We work with our clients to formulate long-term Oracle contracting and cost reduction plans. Then we help our clients execute on those plans. If you have an Oracle ULA or UCC, reach out today and let’s get you on the Oracle cost reduction train.